Should I Buy Life Insurance for My Child?

- Tax Star Mobile

- Nov 8, 2020

- 3 min read

Updated: Jun 2, 2021

Depending who you consult with, the idea of buying life insurance for your children could be a considered a good idea by some, or a bad idea by others. Those who make a commission on selling policies may more than likely preach that it is a good idea. Some financial advisors who come from a perception of making the most use of your take home dollars, may advise against it. So, how do you know what is right for you?

As mentioned in many emails and blogs by Tax Star Mobile, LLC, financial circumstances are NEVER ONE SIZE FITS ALL. You can't copy and paste financial methods because people generally don't have the same financial situation. STAY AWAY FROM ANYONE WHO TELLS YOU OTHERSWISE. This is why doing a financial check-up, budgets, and setting goals are very important. It serves as the foundation to help you on your financial journey. Remember, nothing is set in stone. You have the ability to make financial adjustments as your situation declines or improves.

Child Life Insurance Basics

Most child life insurance policies are whole life, a type of permanent life insurance. Whole life policies include a savings account called cash value, which grows slowly over time. A parent or grandparent can transfer ownership of the policy once the child reaches adulthood. The other major type of life insurance is term life insurance, which lasts for a set number of years and will expire at the end of the term or when the child reaches adulthood. You can't buy a Term Policy for a child alone, but you could add a small term coverage to your term policy.

So What are the Benefits of getting a Whole Life Policy for Your Child?

The savings component of a permanent life insurance policy, called cash value, grows slowly over many years. This policy earns dividends over time. Dividends received are based on the performance of the company's financials, based on interest rates, investment returns, and new policies sold. Companies with low financial performance typically will not offer whole life insurance. Here are somethings you could do with the cash value: 1. Use the cash value to pay the monthly premiums

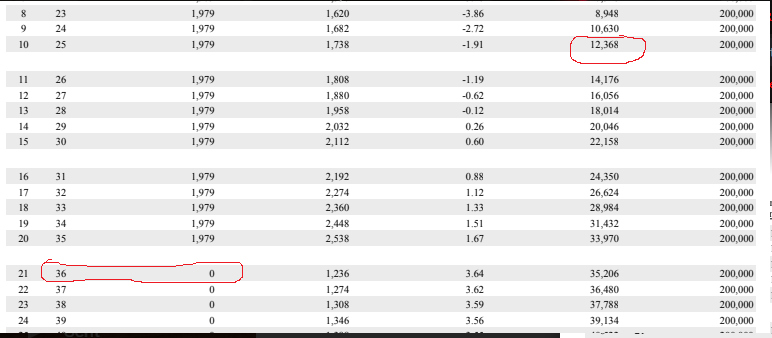

2. Policy holder can use the cash value to invest in other vehicles, such as IRA's to generate more income. 3. Teach your child about paying themselves first by having them to use a percentage of their earnings from their first job to go toward the premiums. 4. Borrow against the policy as opposed to taking loans. 5. Having the benefit of a JUMP START in securing paid off death benefits by the age of 25 or younger, depending on the age you start the policy. SCENARIO Here is a scenario of a whole life policy for a 15 year old girl. Cash Value starts to build by year 1. By the age of 36, the life insurance policy is paid up with the option of adding more coverage. Let's say at age 25 she is ready to purchase a home. She could withdraw at least $12, 368 from the policy, pull out $10,000 from her IRA penalty free, and use the combined total to put down on a $80,000 starter home/condo, which is more than 20% down to avoid PMI (Protection Mortgage Insurance). Or, she can choose to let the cash value grow and use it to contribute to her retirement at age 65 with $93,734 along with her IRA, social security, or employer retirement distributions.

Comments